Double Entry for Disposal of Asset

Eco-certified built with sustainable materials. Such that the values are not double-counted at the consolidated level.

Fixed Asset Accounting Disposal Of Fixed Asset Accounting Corner

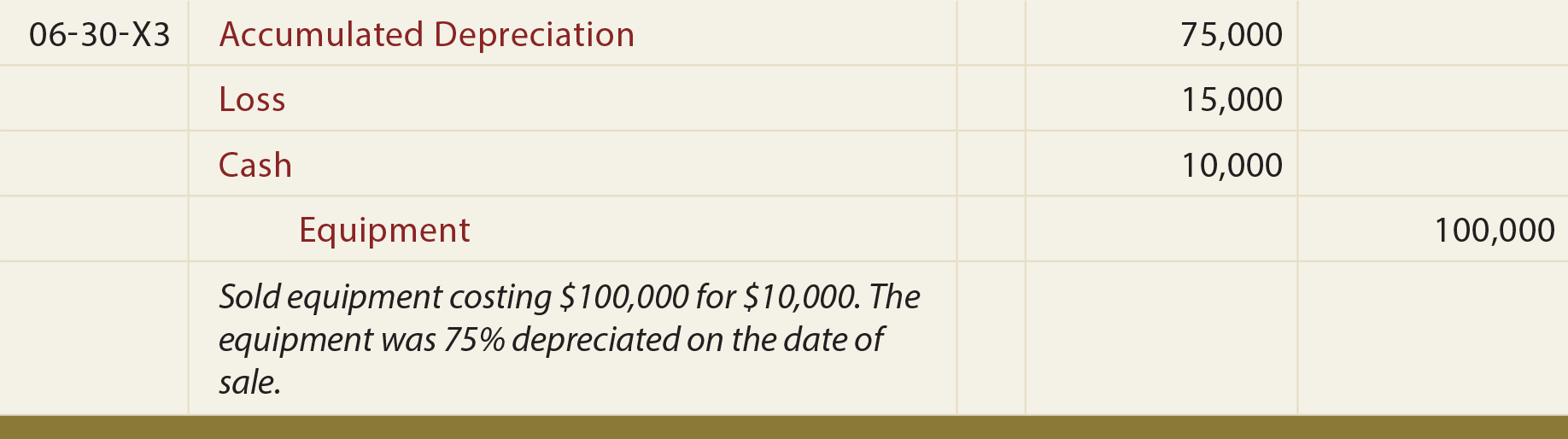

This is completed by creating a journal for double-entry bookkeeping as shown below in the.

. NVIDIA professional graphics support VR-ready option. Gain on disposal is calculated by subtracting the accumulated depreciation from the original cost of an asset and then adding the sales amount. For example an entity may buy a vehicle for cash.

High-performance with 12th Gen Intel Core processors. In this example the asset was purchased for 100000 and accumulated depreciation is 80000. Disposal of Fixed Assets Double Entry Example.

Maintenance schedules work orders depreciation replacement parts inventory lubrication routes and more. Chapter 2 provides only generic provisions. Journal Entry for Gain on Disposal.

The nature of doubleentry bookkeeping. Available to be used by. 2 Record general journal entries for balance day adjustments.

He has been the CFO or. The rules of double-entry accounting require Debris Disposal to also enter a credit of 100 into another of its general ledger accounts. SOLID WASTE DISPOSAL ACT.

1 it has increased the vehicle assets it has at its disposal for generating. Definition Disposal account The disposal account is the account which is used to make all of the entries relating to the sale of the asset and also determines the profit or loss on disposal. Parent Company has recently just begun operation and thus has a simple financial structure.

A disposal of fixed assets can occur when the asset is scrapped and written off sold for a profit to give a gain on disposal or sold for a loss to give a loss on disposal. Consolidation Method Example. A It is this states policy and the purpose of this chapter to safeguard the health welfare and physical property of the people.

Enter any proceeds from the sale of the asset in the disposal account. 13 Profit or loss on disposal The value that the non-current is recorded at in the books of the organisation is the. Enjoy simplified fixed-asset tracking with over 300000 US.

Reservoir vent screens should be replaced with 310 micron filters an openings around piping entering the reservoir sealed. The parent company will report the investment in subsidiary as an asset. Ii Date of disposal DDMMYYYY PAGE 3 23.

Sage Fixed Assets is designed to help you account for everything manage many projects. Ideal for designers engineers students. Debris Disposals journal entry Because it has received cash Debris Disposal increases its Cash account with a debit of 100.

Chapter 2 of the Criminal Procedure Act 1977 deals with the issue of search warrants entering of premises seizure forfeiture and disposal of property connected with offences. It does not replace other search and seizure provisions in other laws 426 such as those mentioned above. The remaining value of the fixed asset needs to be shown as an expense on the profit and loss account and reducing the fixed asset value in the balance sheet.

Disposal Date - if an asset has been disposed of the date of disposal as per the Transact sheet will be displayed in this column. Depreciation Journal Entry is the journal entry passed to record the reduction in the value of the fixed assets due to normal wear and tear normal usage or technological changes etc where the depreciation account will be debited and the respective fixed asset account will be credited. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries.

13 Maintain asset register and associated depreciation schedule in accordance with organisational policy procedures and accounting requirements. The act of getting rid of something especially by throwing it away. Loss on disposal.

Born in 384 BCE. Parent the sole owner of Parent Company injects 20M cash into his business. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping.

The two effects on the entity are. Cost of a fixed asset accumulated depreciation value of the fixed asset in the accounts. This chapter may be cited as the Solid Waste Disposal Act.

Residual Value - the residual value that has been recorded on the Transact sheet for particular asset. Debit the loss on disposal account in the same journal entry by the amount of a loss. The main objective of a journal entry for depreciation expense is to abide by the matching principle.

A business has fixed assets that originally cost 9000 which have been depreciated by 6000 to the date of disposal. Configurable with dual M2 PCIe Gen 4 one Gen 3 NVMe SSD storage. A buyer paid 54000 cash for the asset which results in a gain on.

Otherwise mount the filter buggy to the double wall tote tank supports if you receive larger quantities. This data can the. Our most powerful entry-level workstation yet.

A 2 reducer bushing to ¾npt to fit into the 55 gallon drum if you receive your fluid by the drum. Redlist - Enterprise Asset Management Software by Redlist. Note that a disposal transaction has to be recorded on the Transact sheet for all asset disposals.

3 Duality double entry and the accounting equation Each transaction that an entity enters into affects the financial statements in two ways. Double Taxation Relief If you wish to claim relief for foreign tax in respect of a disposal that gives rise to a liability to capital gains tax shown above provide the following information in respect of each such foreign disposal Country Amount of gain Amount of foreign tax for. If you have a gain credit the gain on disposal account by the amount of.

Acts 1989 71st Leg ch. In the Macedonian region of northeastern Greece in the small city of Stagira whence the moniker the Stagirite which one still occasionally encounters in Aristotelian scholarship Aristotle was sent to Athens at about the age of seventeen to study in Platos Academy then a pre-eminent place of learning in the Greek world. 21 Record depreciation of non-current assets and disposal of fixed assets in accordance with organisational policy procedures and accounting requirements.

Last modified November 13th 2019 by Michael Brown. The best free asset tracking software is AssetTiger due to its useful alert system unlimited cloud storage and number of users but it is. Coordinate and manage every aspect of your fixedmobile assets.

When the money is received your company makes the following entry. Pre-crisis bank balance sheets were natural homes for Hard Assets such as Real Estate and Aircraft.

Disposal Of Pp E Principlesofaccounting Com

Journal Entries For Retirements And Reinstatements Oracle Assets Help

Fixed Asset Trade In Double Entry Bookkeeping

Igcse Gcse Accounts Understand How To Record The Disposal Of Final Fixed Assets Youtube

Comments

Post a Comment